Postal Customs Data

Identify what data and documentation is required when sending on our globalpriority Europe and globalpriority ROW services.

A customs declaration is required for all exports of parcels from the UK to overseas destinations (and imports of parcels to the UK from overseas). The customs declaration is managed and submitted by Parcelforce Worldwide (and our chosen partners) as appropriate for each product. Customs agencies use the information provided within the customs declaration to ensure items are compliant with their own local regulations and to calculate what, if any, tax and duties are due. If you are sending goods to a country outside of the UK, you must provide full and accurate information to avoid parcels being rejected by customs. For more information please visit gov.uk's website.

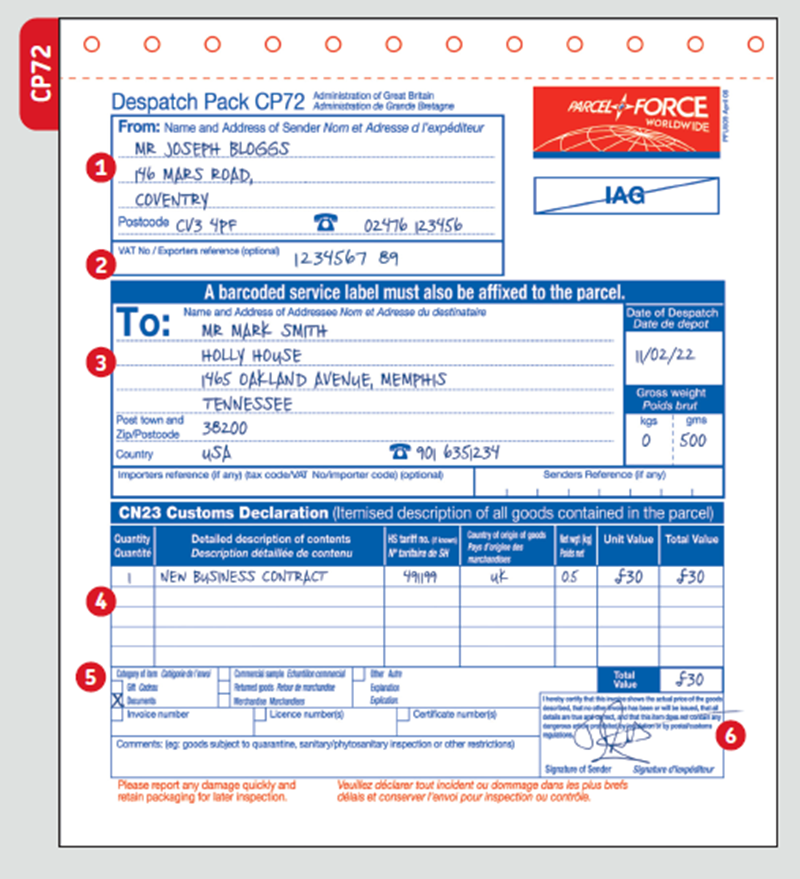

The CP72 and CN23 are officially recognised documents to capture essential details to support and make the customs declarations in the UK and in destination countries.

Each destination is responsible for setting their own import controls on restricted goods. Customers are advised to identify whether items being imported into a specific destination will require licences / certificates or incur additional charges. To identify specific Country requirements, please visit our individual country pages.

*Please note: When sending items from Northern Ireland to the EU, no customs declarations are required for sending gifts or goods.

A commercial invoice is a supporting document for customs purposes. The commercial invoice enables the overseas customs authorities to confirm required information about the goods you are sending.

These documents must be physically provided when sending the item. We recommend you include these physical documents within a plastic wallet affixed to the outside of the parcel. You must attach this to the same side as your address label where size permits, however if this not possible, we suggest that you attach it on the reverse/back of the item if there is sufficient space. Items sent without valid or incorrectly or partially completed documents may be delayed or returned to sender. These documents will need to be completed accurately and in full, the easiest way to do this is via our online journey. Alternatively you can do this at any Post Office® branch or depot*.

You must ensure that you are confident that the information provided is true and accurate reflection of the items being dispatched. PFW cannot be held liable for any incorrect information but the sender can be legally responsible for ensuring data provided for customs purposes is accurate. It is worthwhile ensuring that you are familiar with the customs laws for exporting and importing.

*Please note: If purchasing our services via the Post Office® you will only be asked to complete a CP72

Electronic customs data is also mandatory. Any items with incomplete or missing data may be delayed or returned. The easiest way to do this is via our online journey.

This is the documentation you should expect to see and be asked to complete if sending your item at the Post Office(r).

This is the documentation you should expect to see and need to complete if sending your item via our online journey.

| Products | Data Needed | Documents |

|---|---|---|

|

globalpriority Europe |

Sender’s Details in FULL, including Phone NumberIt is a requirement to include the senders full name, address and postcode, alongside phone number. A GB EORI number or VAT registered number (Where applicable) if the sender is a businessRecipients Details in FULL, including Phone NumberIt is a requirement to include the recipients full name, address and postcode, alongside phone number. This must be a local phone number and not a UK number. Reason for ShipmentFor example gift, sold, returned goods or sample Content DescriptionThis must be as detailed as possible e.g. Womens cotton t-shirt / Childrens board game / Cadbury's Milk Chocolate Bar Not: Clothing / Toy / Sweets Customs use the content description to facilitate border checks The HS/Tariff Code (Minimum 6 digits)Tariff Codes are an internationally recognised standard which means your items can easily be identified worldwide by all customs systems, regardless of language barriers. This makes it easier for overseas partners to process the item through customs. To find out more please click here. (Please note that, PFW cannot be held liable for the HS code selection). Item value for each individual item in the parcelPlease DO NOT combine the value of the parcel, if the content is not the same. If you have a mixture of goods within the parcel, these MUST be entered separately. The item value is the customs value of the goods and should not include postage. Items can not be declared as zero value regardless of why the item is being sent - this includes gifts, samples, returns/repairs etc. See here on how to value goods for customs purposes. Individual item weight for each item in the parcelAccurate weights are required for each item in the parcel to ensure that the customs duty and taxes can be calculated where applicable to weight-based calculations. Country of OriginThis means the country where the goods originated e.g. were produced, manufactured or assembled. PostagePostage should be declared seperately and not included in the item value calculation Senders SignatureThis confirms your liability for the item in terms of the contents of the parcel. |

CP72 /CN23 Documentation required will vary dependant upon method of purchase. |

Certain goods being exported to some countries may require an export licence or a document from other regulatory bodies. Attach it to the package in a clearly marked envelope. Customers must also advise us of this electronically as part of the booking process.

Please check with the relevant government department prior to shipping your goods to see if they require additional licenses or documents.

For items being sent to countries outside of the UK the customs thresholds at which point taxes and duties are applicable will vary from country to country and are decided by local customs authorities. We would always recommend that you check these before sending and further information on this can be found here.

For customers sending an item from NI to the EU there is no requirement to complete and apply a customs declaration. NI remains in the EU Customs Union and therefore customs taxes and duties are not applicable. The taxes and duties applied depend on the individual contents of the parcel, the weight, and the value.

Yes, if you are shipping item/s to the Channel Islands you will require custom declarations. This includes Jersey, Guernsey, Alderney, Herm and Sark. Please note goods to Jersey may also be liable for GST (Goods and Service Tax) which is currently 5%. Find out more about shipping to the Channel Islands at our Worldwide Directory.